- Key Performance Indicators:

- US$2.03B Net Present Value ("NPV") (8% discount, after-tax)

- 24% Internal rate of return ("IRR")

- 4.9 years Payback Period

- Life of Mine ("LoM") Gross Revenue of $20.8 billion

- LoM Free Cash Flow ("FCF") of $7.3 billion (unlevered)

- Cash costs (C1) of $1.82 and All in Sustaining Costs ("AISC") of $2.00 per pound of copper

- Financial and operational executability now through transition to Open Pit operation

- 94% material from open pit mining (Cactus West and Parks/Salyer), 6% from the Stockpile and Cactus East underground

- 232 million pounds ("lbs") (116,052 short tons ("st")) average annual copper cathode production over the first 20 years of operation and a total of 5,339 million lbs (2,669,342 st) of copper cathode produced over the 31-year operating mine life

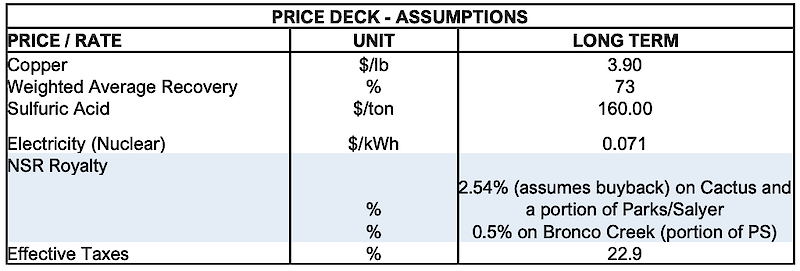

- Cactus Project is well positioned to add value in a variety of copper price environments

| Copper Price Assumption | $3.90/lb Cu | $4.50/lb Cu |

| NPV8 (after-tax) | $2,032 million | $2,927 million |

| IRR (after-tax) | 24% | 30% |

| Payback (after-tax) | 4.9 Years | 4.5 Years |

| Development Capital | $668 million | $668 million |

| LoM FCF (After Tax) | 7,295 million | 9,777 million |

Casa Grande, AZ and Toronto, ON, August 7, 2024 – Arizona Sonoran Copper Company Inc. (TSX:ASCU | OTCQX:ASCUF) ("ASCU" or the "Company") today reports the results from an NI 43-101 Preliminary Economic Assessment ("PEA") on its 100%-owned brownfield Cactus Project in Arizona, USA. The PEA supersedes the previously released Pre-Feasibility Study ("PFS") in all respects, and rescopes Parks/Salyer as an open pit operation resulting from the inclusion of the MainSpring property. The inclusion materially improves the economics and operations of the project, producing a total of 5.3 billion lbs or 2.7 million st of LME Grade A Copper Cathodes over a 31-year operating LoM via heap leaching and solvent extraction and electrowinning ("SXEW"), an established and industry standard hydrometallurgical extraction technology. All dollar amounts referenced herein in US dollars, and all references to tons are imperial or short tons, unless otherwise noted; 1 short ton equals approximately 0.91 metric tonnes. The Company previously issued a news release on JUL 16, 2024 (the "MRE News Release"), disclosing an updated mineral resource estimate (the "2024 MRE") for the Cactus Project which formed the basis for the PEA.

A webinar will be held on August 8, 2024, at 10:30 am ET. Please join George Ogilvie, Nick Nikolakakis, Bernie Loyer, Steve Dixon and Anthony Bottrill in discussion of the PEA and the Company's next steps by registering here https://www.bigmarker.com/vid-conferences/ASCU-VID-THF-07082024.

The PEA is preliminary in nature and it includes inferred mineral resources that are considered too speculative

geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the project described in the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

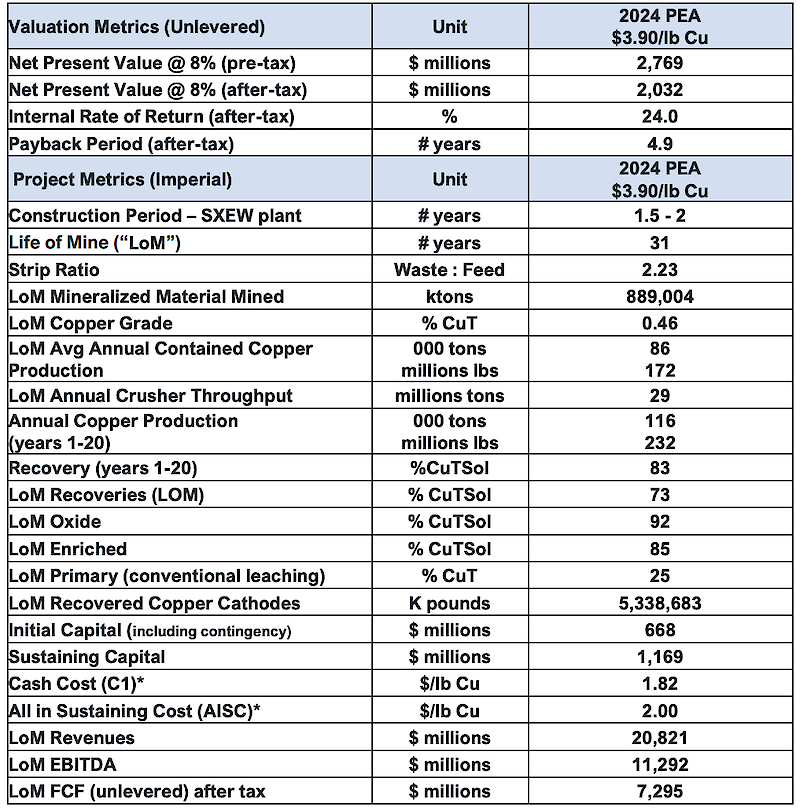

TABLE 1: SUMMARY OF KEY METRICS

Notes:

*Project operating costs include mine operating, process plant operating, and general and administrative costs ("G&A"). Total production costs include royalty expense. The AISC additionally includes initial Capex, sustaining Capex, reclamation & closure.

George Ogilvie, ASCU President and CEO commented, "We achieved, and far surpassed each goal to demonstrate leading NPV, IRR and payback and all other operational and economic metrics from the Cactus Project. The PEA represented herein delivers a highly compelling copper mining operation, on a standalone basis. The project size and top-tier location are complemented by a highly skilled operations and development team already based in Casa Grande and motivated to deliver an executable plan. After completing the MainSpring title transfer in March 2024, and subsequently obtaining the General Plan Arrangement approval, MainSpring's integration to Parks/Salyer positively impacts the operations, lowers mining risks and is overall transformational to the economics.

He continued, "We now look forward to completing metallurgical programs and the infill drilling to support a PFS expected in 1H2025. Clearly, Cactus shows merit on a standalone basis and we will continue to move forward with this mine plan, while continuing to work with our partner, Nuton Technologies, a Rio Tinto Venture. We envisage Cactus, a brownfield Copper Mine as having the size and scale capable of making a meaningful positive impact to the US copper mining industry."

Key Impacts on the NPV:

- Mine plan execution rescopes to 94% open pit

- Parks/Salyer and Cactus West are open pit operations; changes positively impact annual throughput, mining costs, operating costs and processing costs.

- Mineralized material impacts

- LoM tonnage processed of 889 million st, including:

- 659 million st of oxides and enriched material

- Parks/Salyer: 69%

- Including: new MainSpring inferred mineral resources of 245 Mst @ 0.39% CuT (PR dated JUL 16, 2024)

- Cactus West: 23%

- Cactus East: 6%

- Stockpile 2%

- Parks/Salyer: 69%

- 230 million st of primary sulphides to the leach pads with current recoveries reported at an average of 25% from year 15

- Parks/Salyer 34%

- Cactus West: 66%

- 659 million st of oxides and enriched material

- LoM tonnage processed of 889 million st, including:

- Processing cost impacts

- Processing initial capital expenditure ("capex") of $511 million including contingency (SXEW plant and owner's costs)

- Processing sustaining capital of $553 million (process plant - average of $18 million per year)

- Processing operating costs ("opex") of $2.29/st

- Other cost impacts

- Updated salvage cost, land sales, closure and royalties

- Mining cost impacts

- Mining opex and capex impacted by Parks/Salyer rescope to an open pit mining operation

- Parks/Salyer cut-off grade of 0.1% cut off grade

- Initial Capex of $157 million (pre-production stripping)

- Mining sustaining capital of $544 million, optimizing the per ton mining costs (average of $18 million per year)

- Operating expenditures of $8.16/t processed

Bernie Loyer, ASCU SVP Projects commented, "The evolution of the MainSpring and Parks/Salyer open pit combination as demonstrated by this PEA presents a profound change to the Cactus Mine business case. That impact can be gauged in the project's robust economics and also in the contribution that this generational asset is expected to make to our local communities for years to come. With the anticipated creation of more than 3,000 direct and indirect jobs and more than $2.2 billion in life of mine federal and state tax revenues, Cactus Mine is anticipated to become a cornerstone business for the local economy. Great copper projects are where you find them and that often translates to remote and sometimes complicated jurisdictions around the world. In contrast, the combined heritage of the Arizona and Pinal County copper mining legacy married to a Casa Grande venue sets an incredible launch platform for this great project."

Nick Nikolakakis, ASCU CFO commented, "The economics at Cactus in the PEA afford us an opportunity to begin seeking project financing. The Company has been in initial discussions with a group of lenders including commercial banks and an export credit agency. Cactus is projected to generate robust cash flows over a 30+ year mine life. The current economic metrics present a unique opportunity for the Company to actively pursue financing alternatives as the project advances towards a pre-feasibility and definitive feasibility study in 2025."

The Company intends to file a technical report (the "Technical Report") in respect of the PEA in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") on SEDAR+ (www.sedarplus.ca) under the Company's issuer profile and the Company's website within 45 days of the MRE News Release.

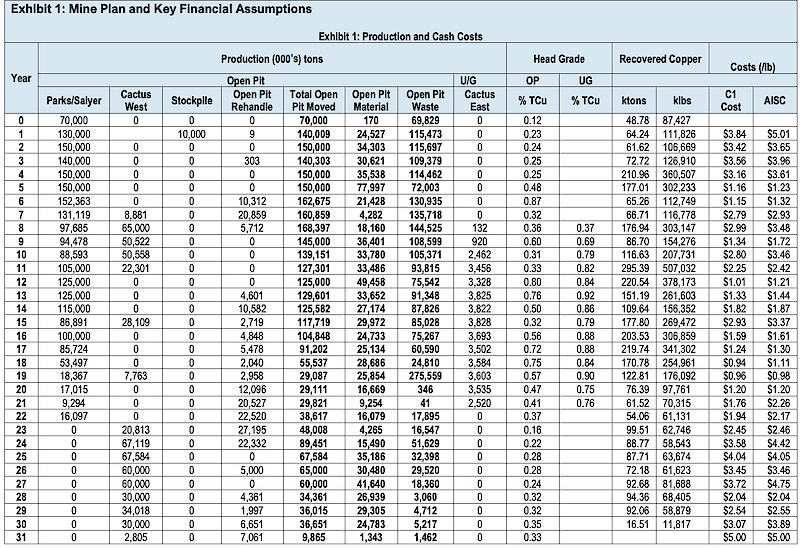

Preliminary Economic Assessment Summary

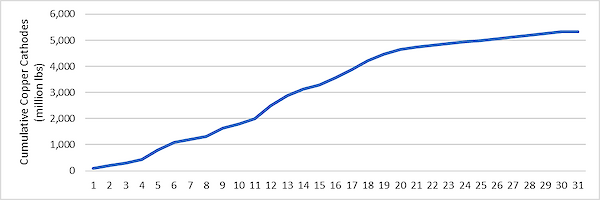

The 2024 PEA supersedes the PFS titled "Cactus Mine Project NI 43-101 Technical Report and Pre-Feasibility Study, Arizona, United States of America", dated March 28, 2024 (with an effective date of February 21, 2024) ("March 2024 PFS") in its entirety. The PEA integrates the new Parks/Salyer additions from the MainSpring property as inferred mineral resources, re-scoped as an open pit. By applying open pit mining costs to the Parks/Salyer mineral resource estimate, it now contributes 531 M tons of feed material grading 0.530% CuT to the total 889 million tons of feed material at 0.46% CuT over the LoM. FIGURE 1 illustrates the cumulative stacked production in this PEA. Overall, the Cactus Project PEA envisages a 31-year mine life with annual average throughput of 29 million tons, for an average of 86 kstpa of copper cathodes produced annually. The result is a lower risk brownfield open pit mining operation with a long life and a streamlined permitting process on private land in Arizona with water rights and access to water from in-situ water wells.

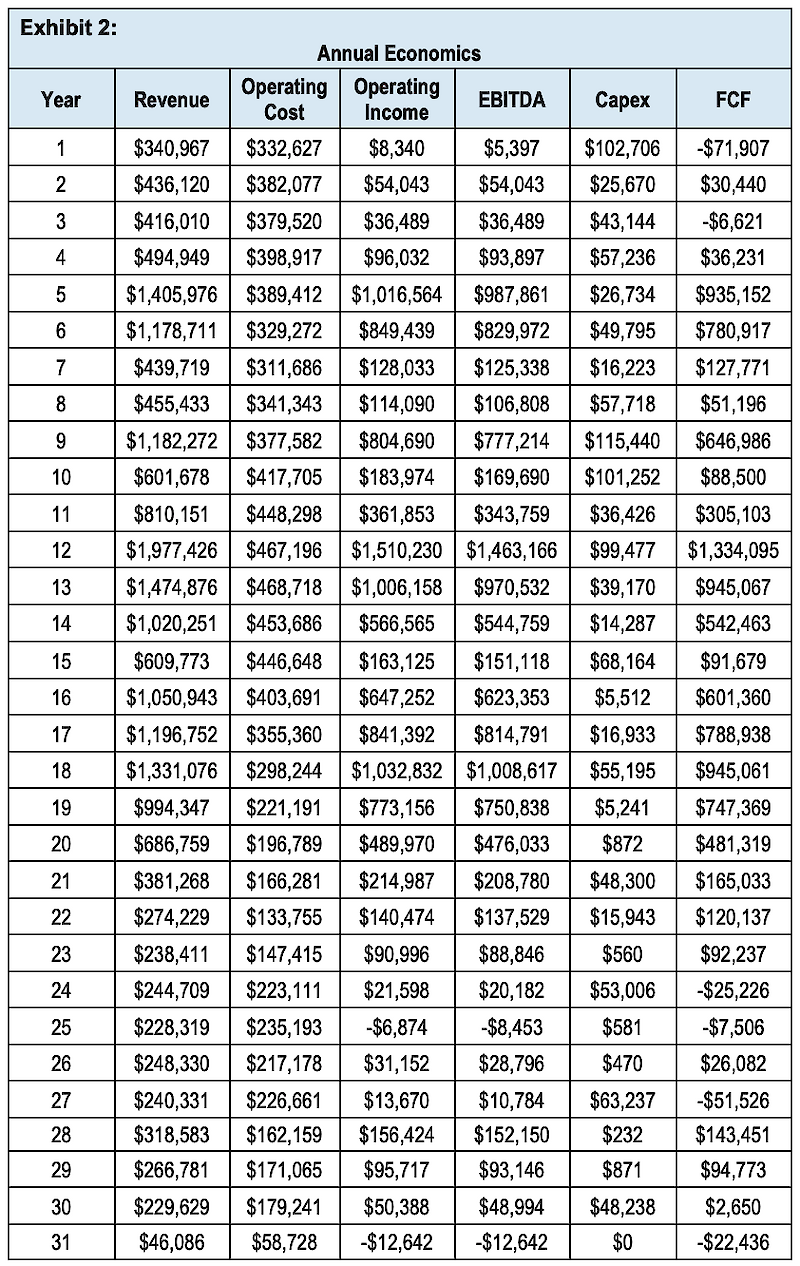

A total of 2,872 million tons will be mined and a total of 889 million tons processed, recovering 5.34 billion pounds of copper cathodes over the LoM or 2,669,000 tons. Copper cathodes will be produced directly onsite via heap leach and SXEW, including a four year ramp up period. Total Copper recoveries are planned at an average of 73%, extracting copper from the oxides, enriched and primary sulphides. See Exhibit 1 and 2 for mine plan, sequencing, costs and economics. Gross acid usage is calculated at 22 lbs per ton at a cost of $160 per ton.

FIGURE 1: Cumulative Stacked Recoverable Copper

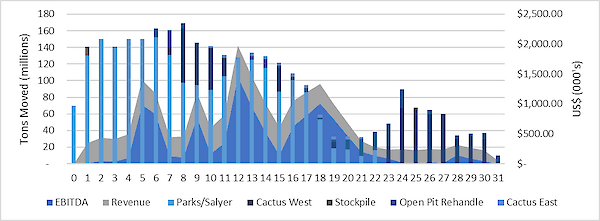

FIGURE 2: Annual Production and Revenue and EBITDA

Onsite facilities at the mine site will consist of two open pits, one underground mining operation, a fine crushing plant incorporating all crushing, classification, agglomeration and conveying systems, heap leach pad, water supply and distribution systems, technical and operational support offices, additional electrical substation, warehousing and an SXEW process plant. Onsite supporting infrastructure will include site power distribution, access roads, mine operations infrastructure, and heap leach facilities, of which the power and roads are already in use.

Current onsite and nearby infrastructure includes:

- Onsite administration buildings, geology, core storage, completed earthworks, substation, parking lot and access roads

- Clean power via onsite substation for $0.07/kWh

- Paved access roads and easy access to interstate highways I-8 and I-10

- Union Pacific railroad line adjacent to the property

- Casa Grande, Maricopa and Phoenix are all located nearby to supply materials/consumables in addition to a skilled labour pool

- Permitted water available onsite, and additional water may be available through the city

- Flat land and low altitude

- Located within the City of Casa Grande industrial park

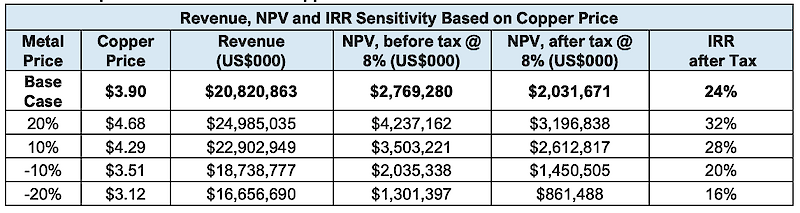

TABLE 2: Report Sensitivities to the Copper Price

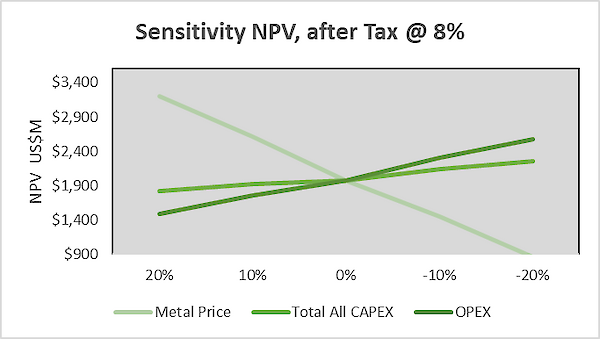

FIGURE 3: NPV Sensitivity to the Metal Price, CAPEX and OPEX

Mining and Processing Operations

Mineralized material will be sourced mainly from the two open pits with an overall LoM strip ratio of 2:1. The Cactus West pit (1.0:1 strip ratio) and new Parks/Salyer pit (3.2:1 strip ratio) comprise 94% of the total material to the leach pads. The remaining 5% of material will be sourced from the Cactus East underground deposit utilizing sub-level cave from the 1,200 ft (366 m) level, and 1% from the Stockpile.

Both Parks/Salyer and Cactus West will be mined using 40 ft (12.1 m) single benches, with ramps sized to allow 320-ton class haul trucks. At Parks/Salyer, all walls have been designed with 45-degree inter-ramp slopes, while geotechnical step-outs are employed to reduce the overall slope to approximately 40 degrees. At Cactus West, inter-ramp slopes range from 45–50 degrees depending on material type, with typical overall slope angles of 41-43 degrees. Gila conglomerate and alluvium constitute the large majority of the waste in the pits.

The mine schedule for open pit mining at Parks/Salyer consists of 531 million tons of feed material grading 0.530% CuT, including 453 million tons of oxide and enriched leach feed material grading 0.55% CuT and 78 million tons of primary sulphide leach feed material grading 0.41% CuT. Open pit mining will initiate in Parks/Salyer in Year -1 and operate continuously for 23 years over seven pit phases. Total waste mined in Parks/Salyer is 1,680 million tons.

The mine schedule for open pit mining at Cactus West consists of 306 million tons of feed material grading 0.29% CuT, including 154 million tons of oxide/enriched leach feed material grading 0.26% CuT and 152 million tons of primary leach feed material grading 0.32% CuT. Open pit mining will take place at Cactus West in the years of 7-11, 15, 19, and 23-31. Phase 1 Cactus West is used to smooth stripping requirements of Parks/Salyer in the middle-years of the mine plan, while Phase 2-3 are mined in the later years and predominantly supply primary feed material. Total waste mined from Cactus West is 299 million tons.

The Stockpile project contributes 9.8 million tons of conventional leach feed material grading 0.24% CuT which will be used for project commissioning in Year 1 of processing.

After a comprehensive review of Cactus East¸ sub-level caving ("SLC") was selected as the preferred underground mining method. A sublevel cave underground mine is planned for Cactus East with development beginning in Year 8 and mining completed in Year 22, peaking at 3.9 million tons per year. Total Cactus East feed material mined is projected to be 42 million tons grading 0.83% CuT. The initial Cactus East SLC level will begin at 1,325 ft (404 m) below the surface over 7 sublevels, to a final depth of 1,845 ft (562 m). Access will be via a single decline with a portal located within the existing Cactus West pit. Haulage of mineralized material to surface will be via a vertical conveyor which can be supplemented with truck haulage to surface via the open pit if necessary.

The Cactus Project heap leaching process design includes crushing of all material types for leaching to a minus ¾" P80 size. All material types, oxides, enriched and primary are to be leached in on a single pad with an initial leaching cycle of 180 days. A maximum 3-year leaching cycle has been assumed (3 lifts) as the practical limit for effective recovery based on experience and hydrodynamic analysis of the materials by HydroGeoScience Inc. (HGS). The copper leaching metallurgical test data has been extrapolated from the testing data at one year based on the rates prevailing after one year using a logarithmic curve fit projection that considers the decaying rate of copper extraction.

Average annual water consumption is planned at approximately 1,200 gallons per minute, the equivalent of 1,935 acre feet per year, well within ASCU's permitted 3,600 acre feet per year industrial use allocation, using in place onsite wells.

The PEA envisages that overall tonnage will comprise approximately 25% oxide material, 50% enriched (secondary sulphides) and 25% primary sulphides within the LoM. From year 15 to 22 placed tons will consist of approximately 25% primary, whereas from year 23, will comprise 100% of the operation. Overall copper extraction is impacted by the lower rates from primary sulphides. In the PEA, ASCU includes a conservative 25% extraction rate.

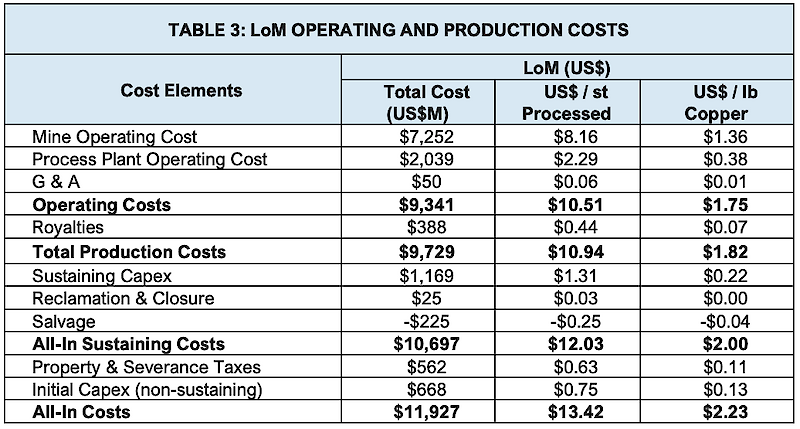

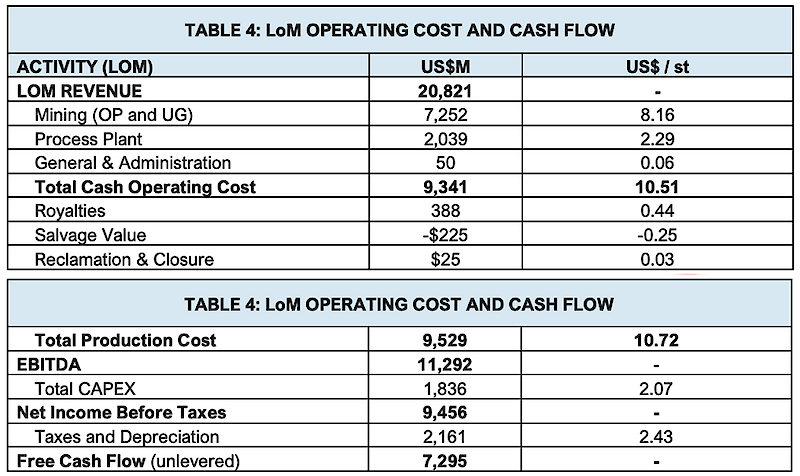

The total LoM costs, operating costs per ton ($/st) of processed material, and dollars per pound ($/lb) of cathode produced are summarized in the three tables below. Project operating costs include mine operating, process plant operating, and general and administrative costs ("G&A"). Total production costs include royalty expense. The AISC additionally includes initial Capex, sustaining Capex, reclamation & closure.

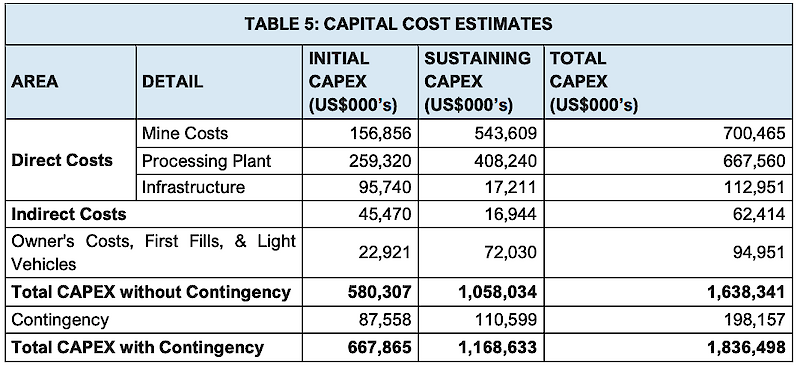

Mining operating cost estimates, prepared by AGP Mining Consultants Inc., are based on a small owner's team managing mining activities using an owner-operator model. Process operating cost estimates were prepared by Samuel Engineering and G&A cost estimates were prepared by M3 Engineering with input from ASCU, as summarized in TABLES 3-5 below (note numbers may not add due to rounding). Sequencing of operations and annual cash flows are detailed in Exhibit 1 and 2, at the end of this release.

The capital cost estimates for the PEA were developed with a -25% to +30% accuracy. The Company uses an estimated overall mining contingency of approximately 18% and according to the Association of the Advancement of Cost Engineering International (AACE) Class 5 estimate requirements.

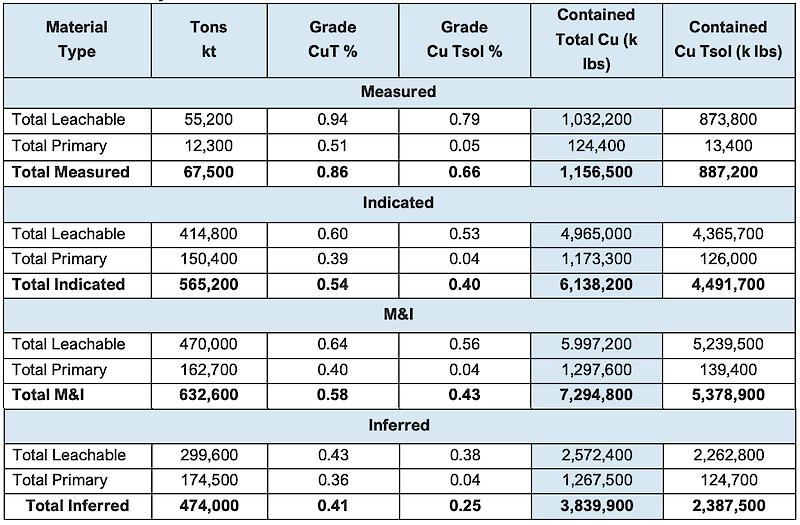

The PEA is based on the updated 2024 MRE, as published in the MRE News Release on JUL 16, 2024, showing a 41% increase of Measured and Indicated ("M&I") pounds and an 89% increase of the inferred pounds. The Mineral Resources for the Cactus Project are shown in TABLE 6 and illustrated in FIGURE 2 below. For more details relating to the 2024 MRE, please refer to the MRE News Release, a copy of which is available on SEDAR+ (www.sedarplus.ca) under the Company's issuer profile and the Company's website (www.arizonasonoran.com).

TABLE 6: Cactus Project Mineral Resource Estimate

NOTES:

1. Total soluble copper grades (Cu TSol) are reported using sequential assaying to calculate the soluble copper grade. Tons are reported as short tons.

2. Stockpile resource estimates have an effective date of 1st March, 2022, Cactus Project mineral resource estimates have an effective date of 29th April, 2022, Parks/Salyer-MainSpring mineral resource estimates have an effective date of 11th July, 2024. All mineral resources use a copper price of US$3.75/lb.

3. Technical and economic parameters defining mineral resource pit shells: mining cost US$2.43/t; G&A US$0.55/t, 10% dilution, and 44°-46° pit slope angle.

4. Technical and economic parameters defining underground mineral resource: mining cost US$27.62/t, G&A US$0.55/t, and 5% dilution. Underground mineral resources are only reported for material located outside of the open pit mineral resource shells. Designation as open pit or underground mineral resources are not confirmatory of the mining method that may be employed at the mine design stage.

5. Technical and economic parameters defining processing: Oxide heap leach ("HL") processing cost of US$2.24/t assuming 86.3% recoveries, enriched HL processing cost of US$2.13/t assuming 90.5% recoveries, sulphide mill processing cost of US$8.50/t assuming 92% recoveries. HL selling cost of US$0.27/lb; Mill selling cost of US$0.62/lb.

6. Royalties of 3.18% and 2.5% apply to the ASCU properties and state land respectively. No royalties apply to the MainSpring property.

7. Variable cut-off grades were reported depending on material type, potential mining method, potential processing method, and applicable royalties. For ASCU properties - Oxide open pit or underground material = 0.099% or 0.549% Cu TSol respectively; enriched open pit or underground material = 0.092% or 0.522% Cu TSol respectively; primary open pit or underground material = 0.226% or 0.691% CuT respectively.For state land property – Oxide open pit or underground material = 0.098 % or 0.545% Cu TSol respectively; enriched open pit or underground material = 0.092% or 0.518% Cu TSol respectively; primary open pit or underground material = 0.225% or 0.686% CuT respectively.For MainSpring properties – Oxide open pit or underground material = 0.096% or 0.532% Cu TSol respectively; enriched open pit or underground material = 0.089% or 0.505% Cu TSol respectively; primary open pit or underground material = 0.219% or 0.669% CuT respectively. Stockpile cutoff = 0.095% Cu TSol.

8. Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, sociopolitical, marketing, or other relevant factors.

9. The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there is insufficient exploration to define these inferred mineral resources as an indicated or measured mineral resource; it is uncertain if further exploration will result in upgrading them to an indicated or measured classification.

10. Totals may not add up due to rounding

FIGURE 2: Cactus Project Mineral Resources

Metallurgical Testwork

Metallurgical testwork used for the PEA shows good metallurgical recoveries from all deposits with no deleterious elements. Testing in the PEA shows an average of 73% of total copper extracted overall. A column leach testing program for oxides and enriched sulphides, from Parks/Salyer and the Stockpile, is ongoing at BaseMet and McClelland labs (Tucson, AZ and Reno, NV, respectively). Primary sulphide column leaching is expected to begin in the fourth quarter.

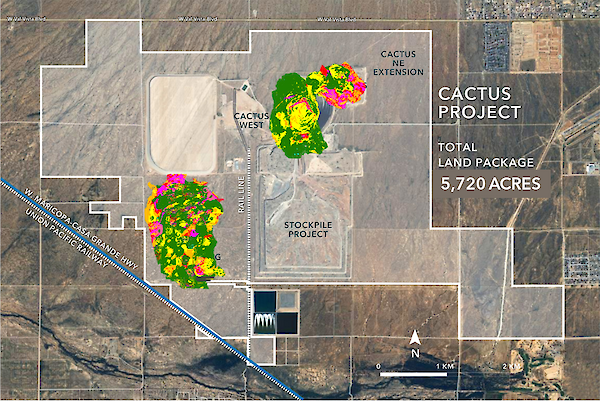

Project Overview

The Cactus Project is a brownfield project located approximately 6 mi (10 km) northwest of the city of Casa Grande and 40 road miles south-southwest of the Greater Phoenix metropolitan area in Arizona. The Greater Phoenix area is a major population centre (approximately 4.8 million persons) with a major airport and transportation hub and well-developed infrastructure and services that support the mining industry. The Cactus Mine Project is accessible on North Bianco Road off of West Maricopa-Casa Grande Highway with direct access to interstate highway 10. During historic ASARCO operations (1974-1984), a rail spur was connected directly with the United Pacific Railroad to ship concentrates to its El Paso refinery in Texas; while the spur has been removed, the onsite rail line is still in existence. Current onsite infrastructure includes power lines and substation, water wells and a water pond, geological buildings, core sheds and administrative offices, keeping the capital intensity low and demonstrating robust economics.

The Cactus Project is host to a large porphyry copper system that has been dismembered and displaced by Tertiary extensional faulting. The major host rocks are Precambrian Oracle Granite and Laramide monzonite porphyry and quartz monzonite porphyry. The mine trend features the formation of horst and graben blocks of mineralization where the Cactus deposits are situated, extending from the Cactus East deposit, southwest to the Parks/Salyer deposit. Drilling to the northeast and southwest along the trend indicates that mineralization continues in both directions and at depth at the Cactus West deposit.

Ownership, Social License and Permitting

The Cactus Project is 100% controlled by ASCU through its wholly owned subsidiary Cactus 110 LLC and encompasses an area of approximately 5,720 acres. The Cactus Project includes exploration and mining on private land and on two Arizona State Land Department ("ASLD") leases. There is no federal nexus for permitting the project and all permitting is limited to State of Arizona-required permits including the Aquifer Protection Permit, Industrial Air permits and the Mined Land Reclamation Permit, each of which ASCU has received from state regulators. Modifications will be required to address changes in the mine plan presented in the PEA.

Of the 5,720 acres, 4,732 acres are considered fee simple and private land. The remaining acreage is State land where ASCU owns either the surface or mineral rights and is in the process of acquiring the surface rights from the State.

ASCU has a well-developed community engagement plan that it has implemented through numerous public meetings and outreach. With the presence of legacy mining in the Casa Grande area and the determination of Cactus as a "brownfield" and disturbed site, the local community is supportive of the Cactus Project. The Company anticipates the Project to create multiple decades of high paying jobs that will benefit the local communities and the state. There is no significant opposition to the Cactus Project.

Royalties

The Cactus Project is subject to three net smelter return ("NSR") royalties based on potential mining production. The MainSpring property does not contain any royalties. The Tembo/Elemental Altus NSR royalty applied to the originally acquired land package including, Cactus and Parks/Salyer may be reduced to 2.54% from 3.18%, with a total payment of $8.9 million. On a portion of the Parks/Salyer deposit, BCE holds a 1.5% NSR royalty, with an option to reduce it to 0.5% for payment of $0.5 million, and ASLD owns a sliding net return royalty (2.0% to 8.0% and estimated at 2%), payable to ASLD and the State Trust. ASCU will formalize the royalty percentages with ASLD once the Company submits a Mineral Development Report to ASLD, thus converting the existing Mineral Exploration Permit, to a Mineral Lease.

Opportunities and Next Steps, including Nuton Technologies

Technical Studies

Following the issuance of the PEA, the anticipated next steps for the Cactus Project include a PFS (which is expected to be completed in 1H2025) (the "2025 PFS"), followed by an early works program, and expects to initiate a Feasibility Study in 2H2025. The Company is planning Project financing for the Cactus Project in conjunction with a potential construction decision.

It is expected that the 2025 PFS will include the major economic and operational rescope; specifically, rescoping Parks/Salyer to an open pit and the additional integration of the Nuton Technologies. Infill drilling programs are planned for Parks/Salyer composing the first 10 years of operations, and into Cactus West for the expansion of primary mineralization suitable for leaching via the Nuton Technologies. Pursuant to the option to joint venture agreement entered into between ASCU and Nuton, a PFS which includes the application of the Nuton Technologies should be issued no later than December 31, 2024, unless mutually extended by written agreement of both parties. Assuming both ASCU and Nuton agree to an extension of such PFS, completion is expected in 1H2025. Completion of the 2025 PFS will require the completion of infill to indicated drilling and updated metallurgical studies, including Phase 2 Nuton metallurgical testing.

Parks/Salyer's grade, scale and scope secures it as the main contributor from day one to the Cactus Project. Cactus West, drilling and finding more primary material. Any future work on the project is not expected to change the mine plan within the first 10 to 15 years of the operation. It provides further optionality on a robust standalone plan.

An Early Works program is in the early phases of being defined and planned for mid-2025, dependent upon funding. The program includes executing the permitting and bonding requirements and optimizing a pre-stripping program for the Parks/Salyer pit. Due to the brownfield nature of the project, roads, power and onsite administration buildings are currently in place.

Nuton Opportunity

The PEA proposes a robust standalone project incorporating conventional leaching technology. In order to capitalize on the primary sulphides, initial test work has validated the application of Nuton proprietary technology. As per the strategy outlined in the option to Joint Venture ("JV") press release, dated DEC 14, 2023, Phase 2 metallurgical testing and Cactus West pit expansion drilling targeting the primary sulphides will be included to the 2025 PFS.

Nuton LLC, a Rio Tinto Venture, is a copper heap leaching technology. Nuton™ became a shareholder in 2022, and a potential JV partner in late 2023. Its Nuton™ suite of proprietary technologies provide opportunities to leach both primary and secondary copper sulfides, providing significant opportunity to optimize the mine plan and the overall mining and processing operations.

Other Future Opportunities

The project has several other opportunities available to continue the optimization of the operation.

- The addition of an In-Pit-Crush-Convey (IPCC) for waste handling instead of truck haulage will be evaluated for improvement in the economics of the project.

- There is a potential to access the high-grade Parks/Salyer material earlier, by moving the Parks/Salyer open pit centroid further northward

Quality Assurance and Quality Control Procedures

Skyline Labs is accredited in accordance with the recognized International Standard ISO/IEC 17025:2005. Their quality management system has been certified as conforming to the requirements defined in the International Standard ISO 9001:2015. The standard operating procedure (SOP) used while processing the ASCU samples was to process samples in groups of 20. Each tray consisted of 18 samples with samples No. 1 and No. 10 repeated as duplicates. The results from each tray were analyzed and any variance in the duplicates of more than 3% would result in the entire tray being re-assayed.

The results of these analyses, including the QA/QC checks, were transmitted to a select set of individuals at ASCU and the qualified persons.

Qualified Persons

Each of the persons listed below are authors preparing the 2024 PEA and have reviewed and verified the contents of this news release as it relates to their area of responsibilities. By virtue of their education, experience and professional association membership, each of the below listed persons are considered "qualified person" as defined by NI 43-101.

Scientific and technical aspects of this news release have been reviewed and verified by these Qualified Person's listed below and Dan Johnson, ASCU Director of Projects, as defined by National Instrument 43-101.

Project Management, M3 Engineering, John Woodson, PE, SME-RM

Metallurgy, M3 Engineering, Laurie Tahija, QP-MMSA

Mineral Resources, Allan L. Schappert, CPG, SME-RM, ALS Geo Resources LLC

Water and Environmental, R. Douglas Bartlett, CPG, PG. Clear Creek Associates, a subsidiary of Geo-Logic Associates

Mine Planning, Gordon Zurowski, P.Eng., AGP Mining Consultants Inc.

Links from the Press Release:

Webinar: https://www.bigmarker.com/vid-conferences/ASCU-VID-THF-07082024

Figures and Tables: https://arizonasonoran.com/projects/cactus-mine-project/press-release-images/

July 16, 2024: https://arizonasonoran.com/news-releases/arizona-sonoran-updates-cactus-project-mineral-resource-estimate-to-7.3-b-lbs-of-copper-in-m-i-and-3.8-b-lbs-of-copper-in/

December 14, 2023: https://arizonasonoran.com/news-releases/arizona-sonoran-and-nuton-llc-announce-option-to-joint-venture-on-cactus-project-in-arizona/

SEDAR+: https://www.sedarplus.ca

About Arizona Sonoran Copper Company (www.arizonasonoran.com | www.cactusmine.com)

ASCU's objective is to become a mid-tier copper producer with low operating costs and to develop the Cactus and Parks/Salyer Projects that could generate robust returns for investors and provide a long term sustainable and responsible operation for the community and all stakeholders. The Company's principal asset is a 100% interest in the Cactus Project (former ASARCO, Sacaton mine) which is situated on private land in an infrastructure-rich area of Arizona. Contiguous to the Cactus Project is the Company's 100%-owned Parks/Salyer deposit that could allow for a phased expansion of the Cactus Mine once it becomes a producing asset. The Company is led by an executive management team and Board which have a long-standing track record of successful project delivery in North America complemented by global capital markets expertise.

For more information

Alison Dwoskin, Director, Investor Relations

647-233-4348

adwoskin@arizonasonoran.com

George Ogilvie, President, CEO and Director

416-723-0458

gogilvie@arizonasonoran.com

Non-IFRS Financial Performance Measures

This news release contains certain non-IFRS measures, including sustaining capital, sustaining costs, EBITDA, C1 cash costs and AISC. The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Cautionary Statement Regarding Estimates of Mineral Resources

This news release uses the terms measured, indicated and inferred mineral resources as a relative measure of the level of confidence in the resource estimate. Readers are cautioned that mineral resources are not mineral reserves and that the economic viability of resources that are not mineral reserves has not been demonstrated. The mineral resource estimate disclosed in this news release may be materially affected by geology, environmental, permitting, legal, title, socio-political, marketing or other relevant issues. The mineral resource estimate is classified in accordance with the Canadian disclosure requirements of Institute of Mining, Metallurgy and Petroleum's "CIM Definition Standards on Mineral Resources and Mineral Reserves" incorporated by reference into NI 43-101. Under NI 43-101, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies or economic studies except for preliminary economic assessments. Readers are cautioned not to assume that further work on the stated resources will lead to mineral reserves that can be mined economically.

Forward-Looking Statements

This news release contains "forward-looking statements" and/or "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expect", "is expected", "in order to", "is focused on" (a future event), "estimates", "intends", "anticipates", "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", or the negative connotation thereof. In particular, statements regarding ASCU's future operations, future exploration and development activities or other development plans constitute forward-looking statements. By their nature, statements referring to mineral reserves or mineral resources constitute forward-looking statements. Forward-looking statements in this news release include, but are not limited to statements with respect to the results (if any) of further exploration work to define and expand or upgrade mineral resources and reserves at ASCU's properties; the anticipated exploration, drilling, development, construction and other activities of ASCU and the result of such activities; the mineral resources and mineral reserves estimates of the Cactus Project (and the assumptions underlying such estimates); the estimates and assumptions underlying the PEA; projected production; pre-tax and after-tax NPV; [pre-tax] and after-tax IRR; payback period; LOM estimates; free-cash flows estimates; AISC and cost estimates; job creation estimates; expected revenues, EBITDA or recoveries; the ability of exploration work (including drilling) to accurately predict mineralization; the ability of management to understand the geology and potential of the Cactus Project; the focus of the 2024 drilling program at the Cactus Project including the Parks/Salyer deposit and MainSpring property; the ability to generate additional drill targets; the ability of ASCU to complete its exploration objectives in 2024 in the timing contemplated (if at all); the completion and timing for the filing of the PEA; the timing and ability of ASCU to publish the 2025 PFS (if at all); the possibility of obtaining an extension of time to issue the 2025 PFS (if at all); the timing and ability to publish a feasibility study (if at all); the scope of any future technical reports and studies conducted by ASCU; the ability to realize upon mineralization in a manner that is economic; the impact of bringing the MainSpring property into the mine plan; the ability and timing of ASCU to commence operations (if at all); the robust economics and opportunity represented by the Cactus Project; the expected impact of the Cactus Project on the local economy and stakeholders; ; the impact of the NutonTM technologies on ASCU operations and cost relating to same; the impact of the relationship with Nuton on ASCU and its operations and any other information herein that is not a historical fact.

ASCU considers its assumptions to be reasonable based on information currently available but cautions the reader that their assumptions regarding future events, many of which are beyond the control of the Company, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect ASCU, its properties and business.Such risks and uncertainties include, but not limited to, the global economic climate, developments in world commodity markets, changes in commodity prices (particularly prices of copper), risks relating to fluctuations in the Canadian dollar and other currencies relative to the US dollar, risks relating to capital market conditions and ASCU's ability to access capital on terms acceptable to ASCU for the contemplated exploration and development at the Company's properties, changes in exploration, development or mining plans due to exploration results and changing budget priorities of ASCU or its joint venture partners, the effects of competition in the markets in which ASCU operates, results of further exploration work, the ability to continue exploration and development at ASCU's properties, the ability to successfully apply the NutonTM technologies in ASCU's properties, the impact of the NutonTM technologies on ASCU operations and cost relating to same, the timing and ability for ASCU to prepare and complete the 2025 PFS and the costs relating to same, errors in geological modelling, changes in any of the assumptions underlying the PEA, the ability to expand operations or complete further exploration activities, the ability to obtain regulatory approvals, the impact of changes in the laws and regulations regulating mining exploration, development, closure, judicial or regulatory judgments and legal proceedings, operational and infrastructure risks and the additional risks described in ASCU's most recently filed Annual Information Form, annual and interim management's discussion and analysis, copies of which are available on SEDAR+ (www.sedarplus.ca) under ASCU's issuer profile. ASCU's anticipation of and success in managing the foregoing risks could cause actual results to differ materially from what is anticipated in such forward-looking statements.

Although management considers the assumptions contained in forward-looking statements to be reasonable based on information currently available to it based on information available at the date of preparation, those assumptions may prove to be incorrect. There can be no assurance that these forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and are urged to carefully consider the foregoing factors as well as other uncertainties and risks outlined in ASCU's public disclosure record.

ASCU disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law.